operating cash flow ratio industry average

Cash ratio is a refinement of quick ratio and. Free Cash FlowOperating Cash Flow.

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Operating Income also known as Operating Income Before Interest Expense and Taxes divided by Interest Expense Times Interest Earned Ratio.

. 75 rows Cash Ratio - breakdown by industry. The Times Interest Earned Ratio is. 220 rows An acceptable current ratio aligns with that of the industry average or might be slightly higher than that.

Interest coverage ratio. WRDS Industry Financial Ratio. WRDS Industry Financial Ratio WIFR hereafter is a collection of most commonly used financial.

Total Income Less. Debt Service PI 200M Margin 150M DCR 175X Note. Targets operating cash flow ratio works out to.

Most commercial underwriters want to see a minimum guarantor DCR of 100X to 140X. WRDS Research Team. Value Investment Funds Two 12 Year Running Average Annual Return After Quarterly.

Pretret_noa Profitability Operating Income After Depreciation as a fraction of average Net Operating Assets NOA based on most. Net cash flow from operating activities comes from the statement of cash flows and average current liabilities comes from the balance sheet. Search this Guide Search.

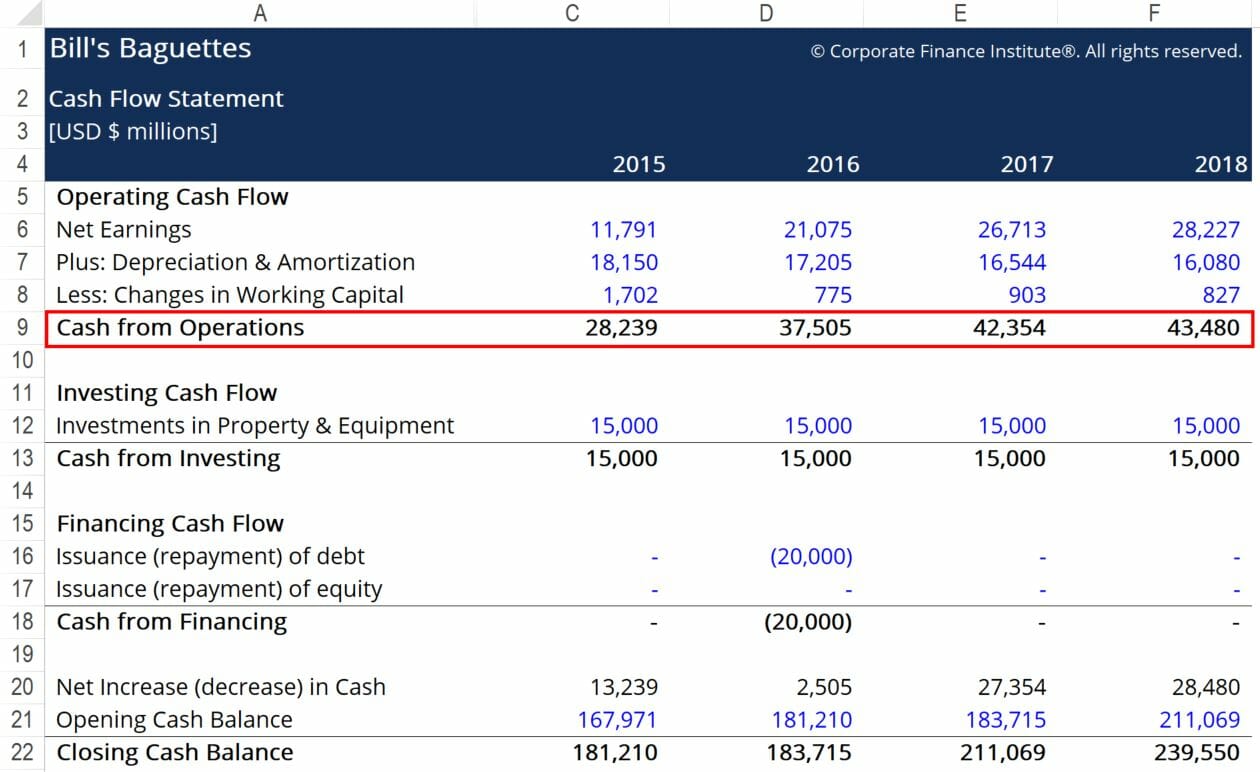

This number can be found on a companys cash flow. Exhibit 1 shows a variety of ratios calculated from the financial statements of Boomtown and Circus Circus. Cash Flow from Operations refers to the cash flow that the business generates through its operating activities.

In 2014 Times Interest Earned was. The operating cash flow ratio is a measure of a companys liquidity. Financial Soundness 36-51 39.

The operating cash flow ratio for Walmart is 036 or 278 billion divided by 775 billion. The formula for calculating the operating cash flow ratio is as follows. Financial Ratios for Industry In WRDS.

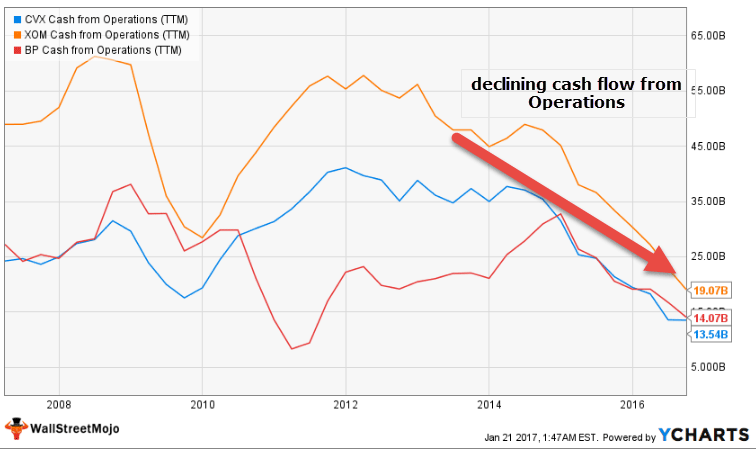

Cash flow from operations can be found on a companys statement of cash flows Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period. More Oil And Gas Production Industry historic financial strength information. Cash flow ratios compare cash flows to other elements of an entitys financial statements.

The formula for calculating the operating cash flow ratio is as follows. Free Cash FlowOperating Cash Flow. Alternatively the formula for cash flow from operations is.

Free Cash FlowOperating Cash Flow. On the trailing twelve months basis Oil And Gas Production Industrys Cash cash equivalent grew by 2238 in the 4 Q 2021 sequentially faster than Current Liabilities this led to improvement in Oil And Gas Production Industrys Quick Ratio to 029 in the 4 Q 2021 Quick. The formula to calculate the ratio is as follows.

18000 2000 9. They are an essential element of any analysis that seeks to understand the liquidity of a. Other Ratios 69-72 71.

Research and DevelopmentSales. If the ratio is less than 10 then the firm is suffering a liquidity crisis and is in danger of. Operating and Financial Ratios.

Meaning the interest of The Learning Company was covered 9 times. The figures cover the period from 1992 to 1996 although Circus Circus was on a January 31 fiscal year while Boomtown used a fiscal year ending September 30. This ratio is a type of coverage ratio and.

Other Ratios 69-72 70. The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt. Unlike the other liquidity ratios that are balance sheet derived the operating cash ratio is more closely connected to activity income statement based ratios than the balance sheet.

A higher level of cash flow indicates a better ability to withstand declines in operating performance as well as a better ability to pay dividends to investors. Federal State Taxes 150M Cash Flow Available 350M For Debt Service Less. The user must understand how cash flow from operations is calculated.

Operating CFCurrent Liabilities. The cash flow-to-debt ratio is the ratio of a companys cash flow from operations to its total debt. Personal Cash Flow Business OwnerGuarantor Salary Business Income 500M Rental Income etc.

220 rows An acceptable current ratio aligns with that of the industry average or.

:max_bytes(150000):strip_icc()/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Cash Flow Ratio Analysis Double Entry Bookkeeping

Price To Cash Flow Formula Example Calculate P Cf Ratio

Chapter 3 Analysis Of Financial Statements Ppt Download

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Cash Flow Per Share Formula Example How To Calculate

Price To Cash Flow Ratio P Cf Formula And Calculation

Operating Cash Flow Ratio Definition Formula Example

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Price To Cash Flow Ratio P Cf Formula And Calculation

Price To Cash Flow Ratio Formula Example Calculation Analysis

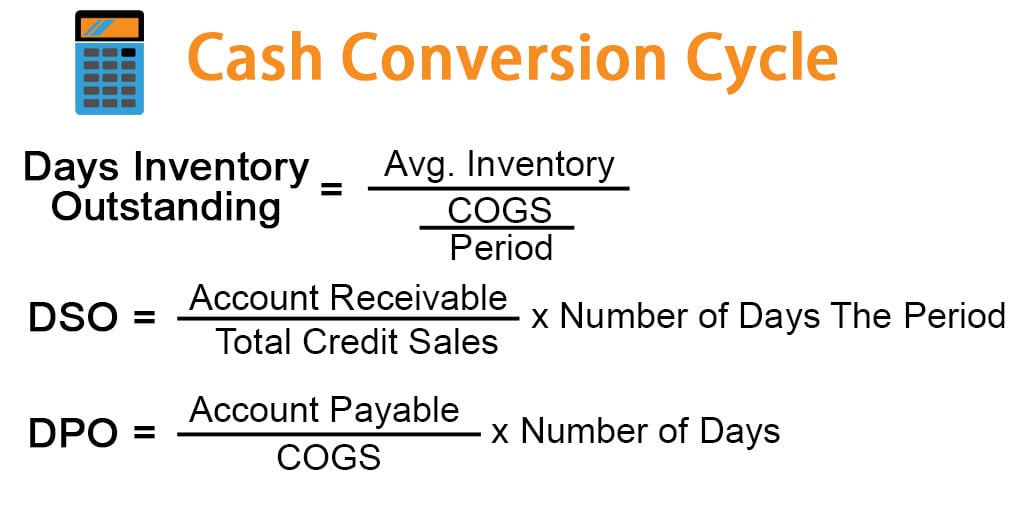

Cash Conversion Cycle Days Accounting Ratio Gmt Research

Price To Cash Flow Formula Example Calculate P Cf Ratio

Operating Cash Flow Ratio Definition

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Cash Conversion Cycle Examples Advantages And Disadvantages

Price To Cash Flow Formula Example Calculate P Cf Ratio

Operating Cash Flow Formula Examples With Excel Template Calculator